If there has been 1 key takeaway from 2023 thus far, it is this; is there any job or task that cannot be accomplished better by artificial intelligence? From college entrance exams to mundane work emails, the emergence of AI in our everyday lives has become a very real and constant phenomenon. It only seems right that the nation’s agency in charge of collecting revenues would want to throw their name in the hat.

The IRS Commissioner Daniel Werfel announced on September 8th, that the IRS would begin utilizing AI to audit large partnerships for any anomalies or discrepancies. It was not made clear what the search criteria would entail or how the AI would be implemented, but the Commissioner championed the use of this technology to track down potential tax dollars that may have been previously left on the table.

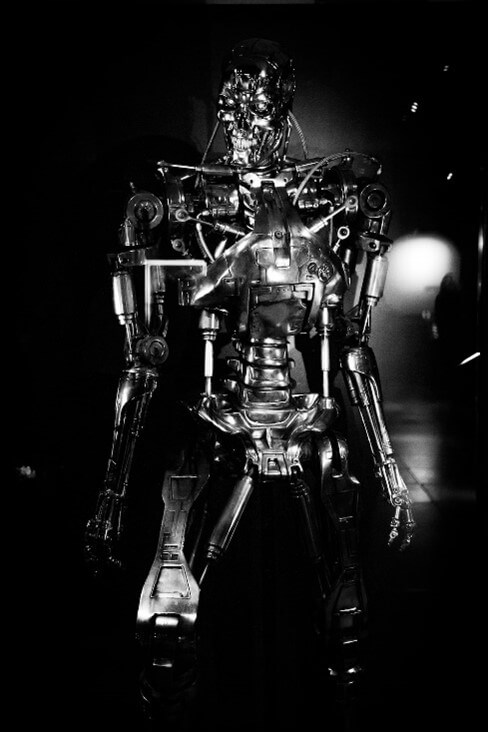

To some this could come as the next step towards the Skynet Judgement Day we are all heading

towards (insert 90’s movie reference here).

However, the utilization of AI in the audit of all Americans could actually lead to a more fair and equitable application of the increasingly complex tax laws. The recent political conversation around the IRS has revolved around the perceived “weaponization” of the IRS against members of an opposing political party. The utilization of AI, which would undoubtedly work off a complex set of algorithms with very little human input needed, could essentially neutralize this constant political ploy. If fundamental fairness of tax collections is a goal of our government there may be no better way to achieve this end, than by taking the human element completely out of the calculus. No matter whether you are a multi-billion-dollar corporation or a taxpayer subsisting on $40,000/year there would be no escaping the AI algorithm that would ensure that all taxpayers are paying their fair share. This utilization of new technology could very well shape how taxes are calculated and collected for all future generations, ensuring that everyone is having the same scrutiny no matter what income tax bracket you may fall in, or this could be just another step for the grossly-underfunded IRS to try to “weaponize” this technology to go after a certain class of taxpayer…I guess we will just have to wait and see.

Adam Holleran, EA

Timberline Tax Group, LLC